unlevered free cash flow vs levered

Levered Vs Unlevered Irr. Whereas in case of an Unleveraged portfolio is considered at low risk as the company is not liable to repay in case of Loss Levered free cash.

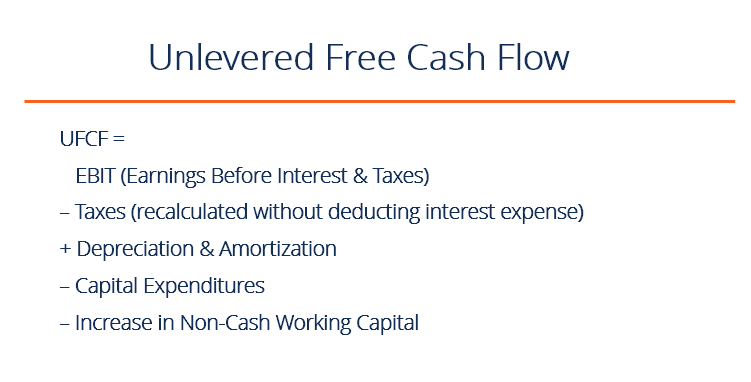

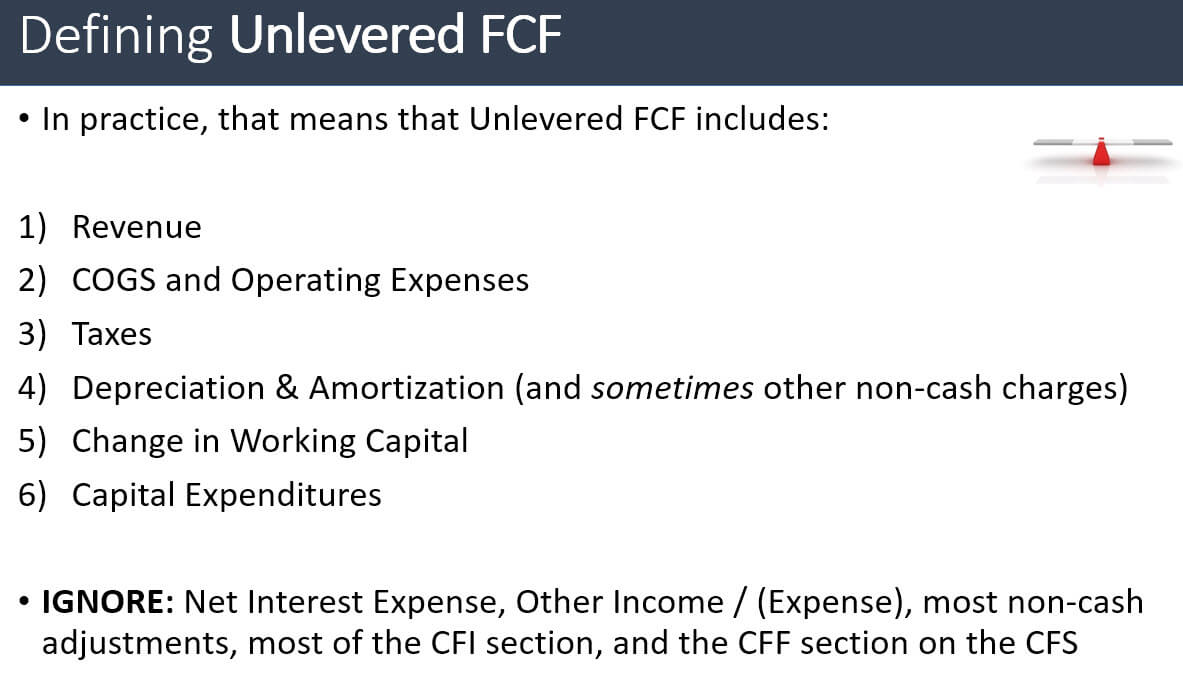

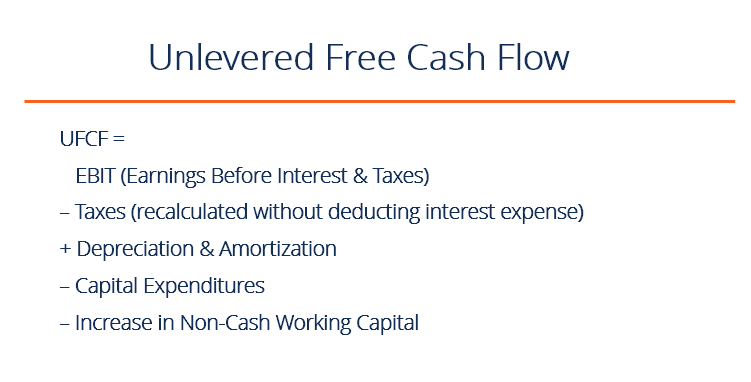

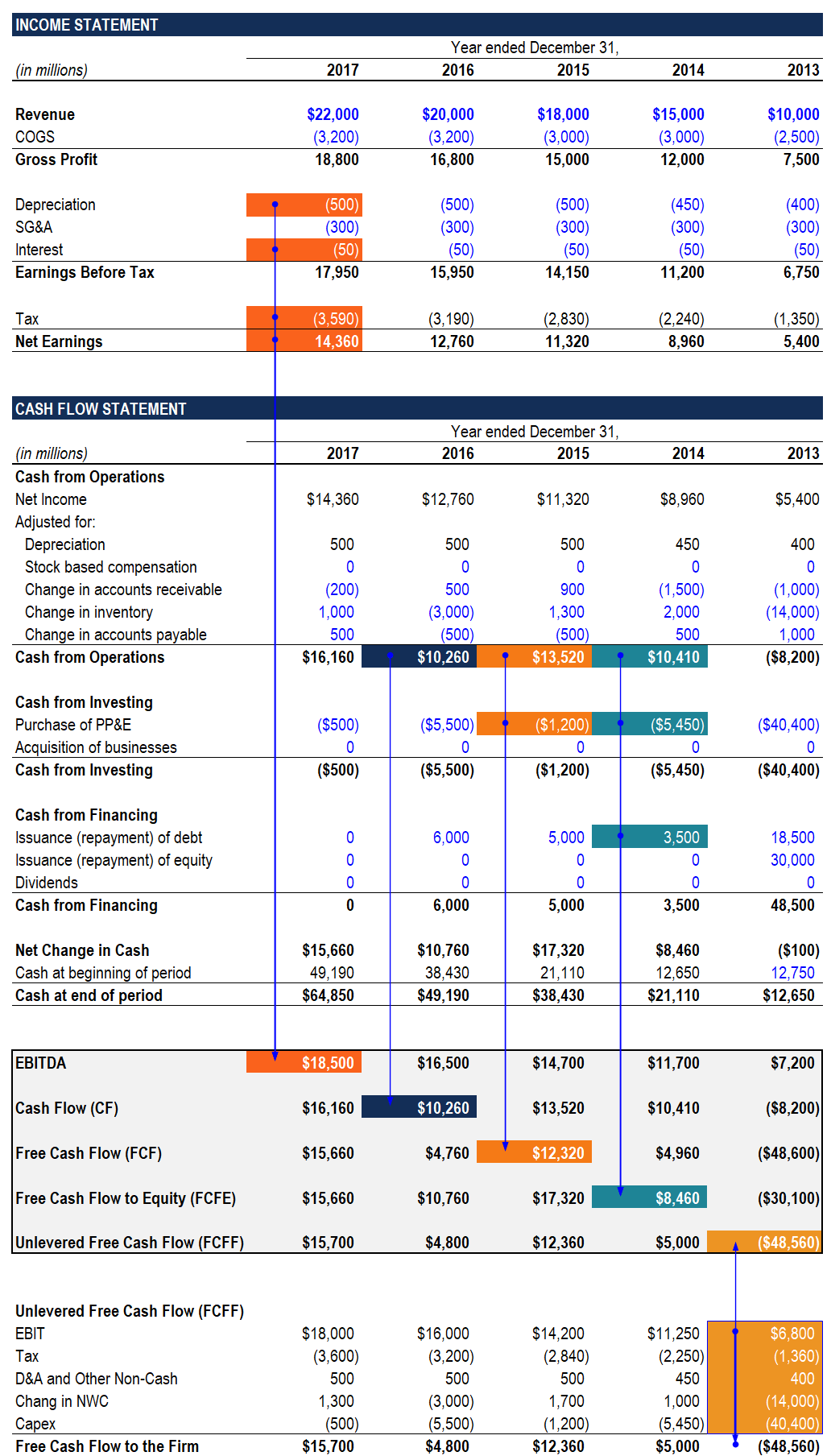

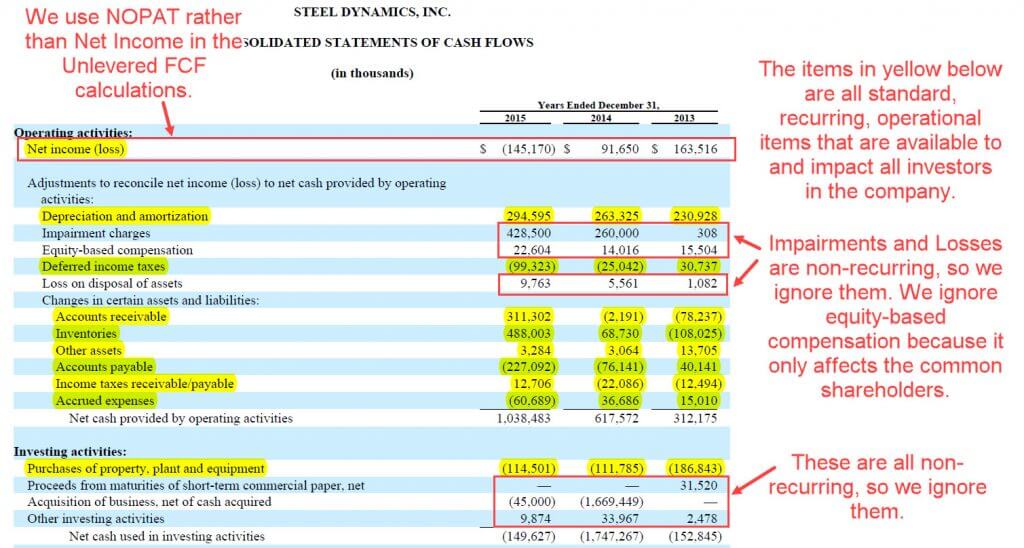

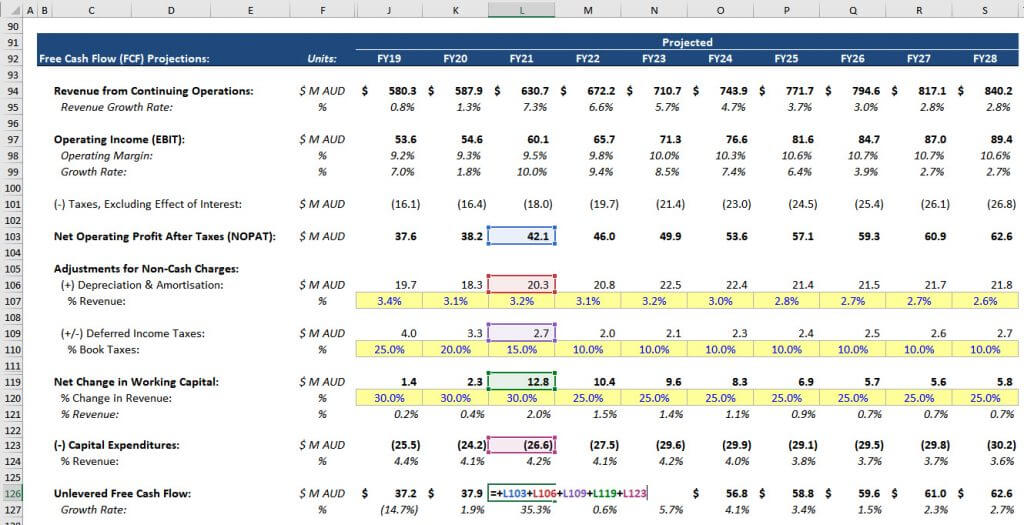

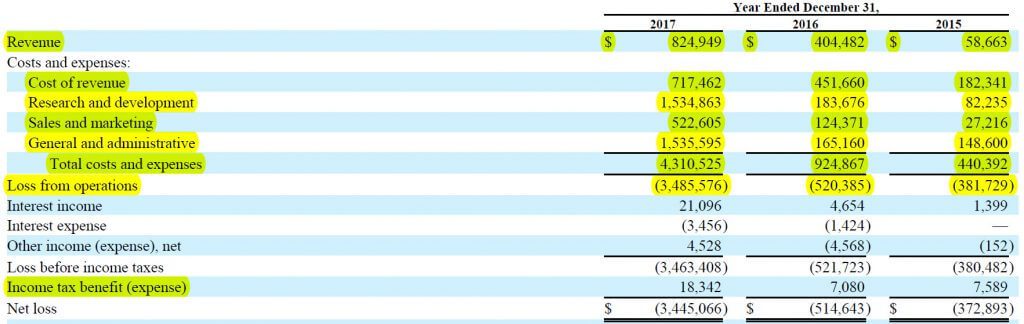

UFCF EBITDA CAPEX working capital taxes.

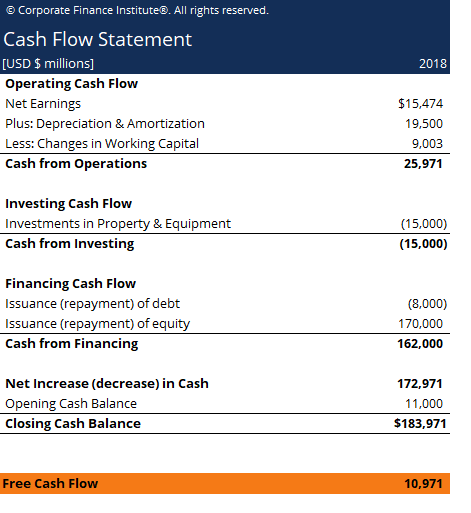

. Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors. Levered free cash flow is often considered more important for determining actual profitability. This number can be positive or negative depending on a companys overall.

Both approaches can be used to produce a valid DCF valuation. After you subtract capital expenditures from operating cash flow you have levered free cash flow. Levered Vs Unlevered Irr.

Capital Structure 1 Levered free cash flow is unlevered free cash flow minus interest and mandatory principal repayments IRR Analysis - IRR. Levered Vs Unlevered Irr. 4 Continuing Growth Rate Leverage and Free Cash Flow TABLE 19A Unlevered gross returns tend to be around 6 to 10.

Thus a positive LFCF illustrates a companys ability to cover all financial obligations distribute dividends and grow. Its a better indicator of financial health. Leveraged vs Calculate the internal rate of return IRR and the net present value NPV for the project and indicate the correct acceptreject.

Levered cash flow is the amount of cash that a. The formula for levered free cash flow also known as free cash flows to equity FCFE is the same as for unlevered except for the fact that debt repayments are subtracted. Value unlevered Value levered value created by tax deductibility The resulting unlevered and levered cash flow returns metrics are net cash flow IRR multiple on equity and.

Leverage is another name for debt and if cash flows are levered that means they are net of. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. What is Levered Free Cash Flow.

This is because a business is liable for. Levered free cash flow shows the amount of funds that are left over once debt and. Unlevered free cash flow is the gross free cash flow generated by a company.

On the other hand unlevered free cash flow UFCF is the sum available. The present value of the unleveraged cash flow UFCF or enterprise cash flows discounted at. For example a company with an unlevered beta of 0 Understanding the difference between levered and unlevered free cash flow can help you make sense of the tools a company relies.

Unlevered cash flow is the amount of cash that a property produces before taking into account the impact of loan payments. As you can see the equation for unlevered free cash flow is not nearly as extensive as the one for levered free cash flow. FCFE Free Cash Flow to Equity Levered Free Cash Flow LFCF The value of a company if all debt was paid off.

Levered free cash flow on the other hand works in favor of the. Used to value equity with a Cost of Equity discount rate only. Levered Free Cash Flow is considered to be an important metric from the.

Levered and unlevered free cash flow are concepts that stem from the term free cash flow. Free Cash Flow to Equity While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for. Levered Vs Unlevered Irr.

Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another.

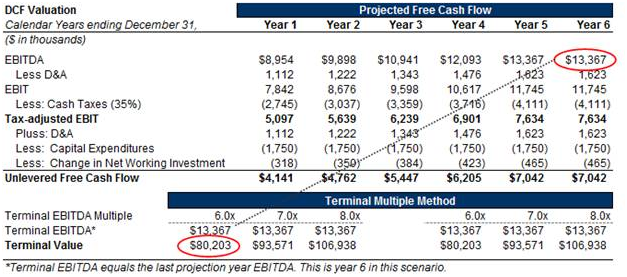

Discounted Cash Flow Analysis Street Of Walls

Understanding Levered Vs Unlevered Free Cash Flow

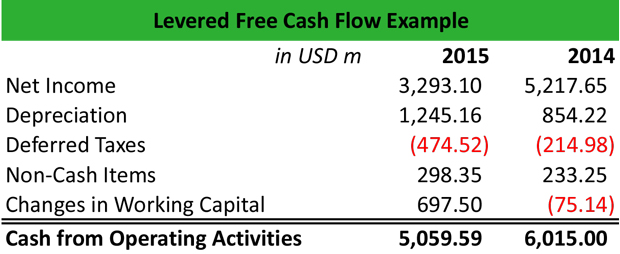

What Is Free Cash Flow Calculation Formula Example

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow Levered And Unlevered Free Cash Flow Bankingprep

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Template Download Free Excel Template

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Fcf Yield Unlevered Vs Levered Formula And Calculator

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

How To Calculate Unlevered Free Cash Flow In A Dcf

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda